Several states have updated building energy codes in recent years, lowering energy and housing costs for residents. We found that despite homebuilders’ claims, new home construction in these states continued at rates in line with national trends.

Modern building energy codes are a key housing affordability tool. By ensuring all new homes meet minimum standards for energy efficiency, codes save new and future residents money on utility bills and reduce the overall cost of housing.

But some homebuilders claim that updating building codes will reduce the number of new homes built. D.R. Horton, the largest home-building company in the country, describing recent energy codes, warned of the “constraints such a jump has on the housing supply.” And the National Association of Home Builders (NAHB)—which has combated energy codes for decades—recently testified before Congress that such codes “will deter new construction.”

We know that home development giants routinely make false claims about the costs and benefits of building energy codes. So we fact-checked these claims about impacts to new home construction as well.

Just in the last couple of years, stronger energy codes have taken effect in several states, providing a perfect chance to look at the numbers. These states adopted the 2021 International Energy Conservation Code (as well as health and safety codes), a meaningful step toward lower energy and housing costs from their previous codes. For instance, the updated code requires better insulation and air sealing, which significantly reduces heating and cooling costs. The bill savings each month dwarf the smaller increase in mortgage payments. Residents also are more healthy, are more comfortable, and can stay safe for longer during extreme weather without heating or cooling, saving lives.

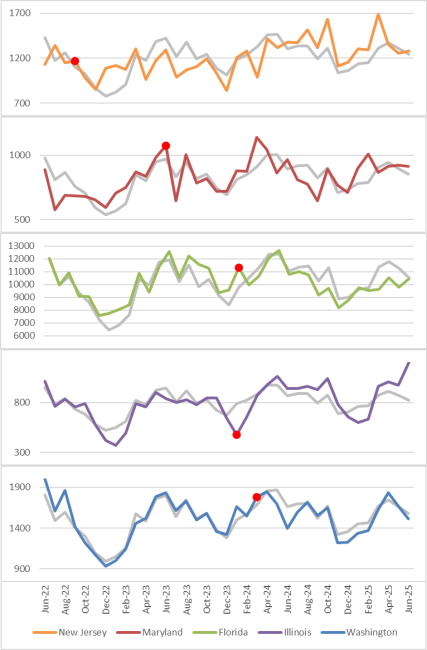

Using U.S. Census data, we looked at the single-family home construction permit rates in the five largest states that have adopted this code before and after it took effect. Before a new code took effect, the month-to-month number of home permits in each state bounces up and down a lot, but roughly follows national building trends. After the new codes took effect, the permits in those states continued to bounce around and generally follow national trends. The code updates had no apparent effect on housing production:

Number of permits for single-family homes in states that adopted the 2021 IECC. Red dots signify when a state’s new code took effect. The grey lines show national permit numbers scaled for comparison to each state.

In total, more than 250,000 new single-family homes have been built or permitted in these five states alone since their new energy codes took effect. We’d love to see even more housing in these and other states—but energy codes aren’t what’s holding it back.

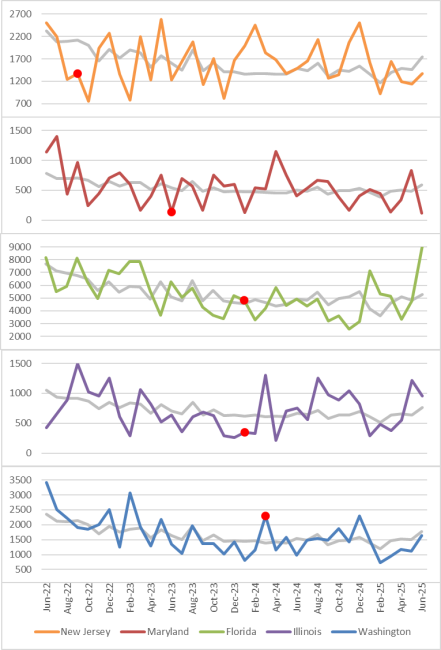

What about multifamily housing? The same states adopted updated codes for apartment buildings and other multifamily housing. Those code updates did not require changes as significant as the ones for single-family homes. Similarly, new permits for multifamily housing in these states did not see any particular divergence from national trends after the new codes took effect:

Number of permits by state for multifamily units. Red dots signify when a state’s new code took effect. The grey lines show national permit numbers scaled for comparison to each state.

We are not the first to identify these trends. For example, a 2024 study by the Midwest Energy Efficiency Alliance and Slipstream found that strengthened energy codes in Illinois had no effect on new home construction in the state relative to neighboring counties in adjacent states. A 2016 study found that residential construction increased in five southeastern states after they adopted new codes. Canary Media found this year that a Massachusetts town with a far more stringent code (requiring all-electric homes) was seeing rapid new construction.

New housing construction is cyclical and is limited by several obstacles

We don’t have space to fully examine this here, but D.R. Horton’s latest 10-K report—a disclosure of risks to investors, information that it can be held to in court—offers a different and more complicated explanation for why its new construction varies over time. It says “homebuilding, rental and land development operations are cyclical and affected by changes in economic, real estate or other conditions,” citing nine factors such as employment levels, consumer confidence, and interest rates. It does not mention building codes or even regulation more broadly. The company offers an array of new homes for sale in states including, yes, Florida, Illinois, Maryland, New Jersey, and Washington.

Factors on the housing supply side could affect production as well. The NAHB has noted wide fluctuations in costs of materials and argued that a skilled labor shortage is slowing development.

A host of additional challenges often hold up multifamily housing: Local zoning simply forbids it in many places, and parking requirements can add tens of thousands of dollars in costs per unit.

Housing affordability and expanded production must go together

The data are clear: Stronger energy codes are not slowing down new home construction. They make housing more affordable by lowering utility bills for residents without constraining housing supply. Housing shortages are driven by other factors.

The choice between reducing energy costs and producing more housing is a false one. We can, and must, advance both at the same time.