Key findings

|

New drivers of electricity demand are emerging, fueling a surge without recent precedent. This explosive load growth is being driven by the rapid expansion of data centers (including those supporting artificial intelligence), new and expanded factories, and the comparatively more gradual adoption of electrified space heating, water heating, transportation, and industry. Forecasts suggest that over the next 10 years the need for electricity will increase 20–50%, while peak demand will increase 19–35% in both summer and winter.

States and utilities nationwide are grappling with how to meet this challenge, with new gas generation being the most common response to maintain energy supply. Utilities have historically overestimated future demand, and uncertainty about when new loads—especially data centers—will emerge risks creating stranded generation, transmission, and distribution assets, saddling ratepayers with unnecessary additional expenses.

The evidence presented in this report supports the conclusion that demand-side management (DSM)—energy efficiency (EE) and load flexibility—should be the first-line option for addressing load growth.

Massive potential

Energy efficiency and load flexibility remain untapped resources in the United States. By 2040, energy efficiency aggregated nationally realistically has the potential to reduce electricity consumption by about 8% and demand by about 70 GW. In addition, most experts agree the United States has about 60–200 GW of load flexibility potential available within the next decade, which by itself is roughly 1–2 times larger than the most aggressive projections of total U.S. data center capacity in 2030. Utility demand-side management programs will be essential in helping to realize this potential.

Less expensive

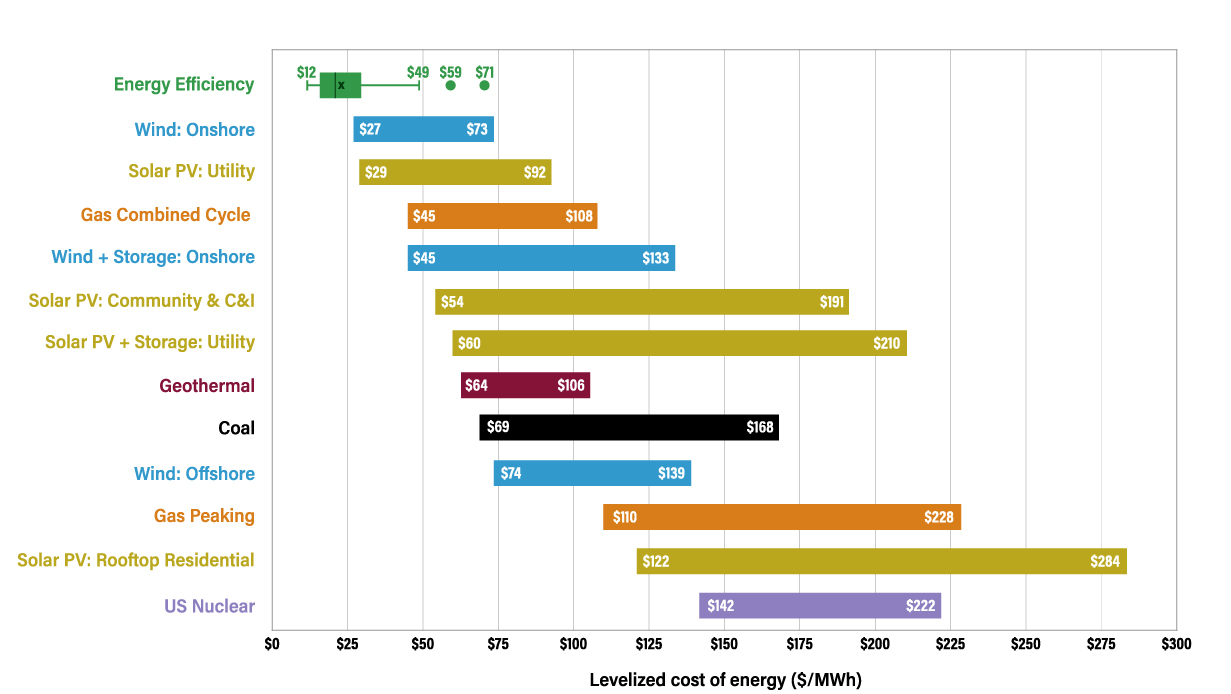

Rapidly rising electricity bills have created an affordability crisis in the United States, particularly for low-income households. There is a pressing need to drive down electricity costs, and demand-side measures offer an ideal solution. Our analysis of the nation’s largest utility programs reveals that the median cost of energy savings achieved through utility EE programs is $20.70/MWh, a value significantly below the cost of all other supply-side resources. Moreover, the cost comparison illustrated in figure ES-1 does not even account for EE’s ability to reduce distribution system costs (e.g., substations, transformers, power lines), which are projected to be among the largest costs created by load growth in the absence of DSM.

Figure ES-1. A comparison of the levelized cost of energy efficiency and supply-side resources. Vertical line and “X” represent the median and mean costs of energy efficiency, respectively. Cost data for supply-side resources calculated by Lazard (2024).

Utility load flexibility programs also achieve peak load reduction at lower cost than supply-side resources. The lowest-cost supply-side resource prices in at $51.72 per kilowatt per year. Utility load flexibility programs can deliver peak demand reduction at a fraction of that cost (see table 4).

Faster

Demand-side resources are ideal for avoiding the cost, siting, environmental compliance, emissions, and delay issues associated with new generation, distribution, and transmission. Utilities have been running DSM programs for decades and are experienced in delivering these benefits to customers and the grid. They can also be ramped up relatively quickly. Since 2015, the fastest-growing utility EE programs had an average annual growth rate in lifetime energy savings of about 43% over a triennium. Virtual power plants can be operationalized in less than six months. Only 6.0% of U.S. energy consumers participated in a retail demand response (DR) program in 2024, demonstrating the massive opportunity to expand the resource.

In comparison, procuring and deploying supply-side resources are considerably slower. Large gas turbines are likely to take 5–7 years to be delivered. Long interconnection queues force solar and wind projects to wait five years on average to connect to the grid. Upgrading and expanding the distribution system can require a similar amount of time or longer to procure equipment and work out land use and permitting issues. The wait for transmission lines often takes a decade or more.

An additional advantage of demand-side measures is that they can be targeted to the regions where load growth relief is needed most without the need to enter lengthy interconnection queues. By reducing load, DSM provides more headroom by freeing up capacity on existing utility infrastructure, thereby enabling a faster accommodation of technologies like electric vehicles and heat pumps without creating distribution bottlenecks.

Better

DSM offers numerous advantages over supply-side solutions while serving as a complementary component to them. It provides a hedge against load and price uncertainty. Ratepayers in vertically integrated markets are often on the hook for new supply-side expenses, whether new load materializes or not. Should load emerge, DSM lightens the load that must be met with generation resources at lower cost than new supply-side investments. Should load not emerge, the utility will have procured a least-cost energy resource that benefits both participating customers and other ratepayers by reducing energy and capacity costs. Demand-side measures also buy utilities time to meet near-term energy needs while waiting to see which loads will actually materialize.

The alternative to maximizing demand-side resources is likely to be massive expenditures for new gas plants and delayed retirements of existing fossil plants. Meeting data center load with fossil resources through 2035 is projected to increase cumulative carbon emissions significantly—by an amount equal to about 10% of 2025’s total global emissions—with the United States and China being the largest contributors by far. This would make it considerably harder to reach decarbonization goals and consign the planet to the avoidable negative outcomes of climate change. A focus on DSM also supports domestic manufacturing and our workforce while avoiding global bottlenecks on supply-side equipment.

Recommendations

Load growth will vary regionally and with time. While specific solutions will need to be tailored to each state’s unique circumstances, there are multiple options that all states and utilities should consider. These include the load flexibility strategies presented in table ES-1 and the lengthy list of EE measures provided in Appendix C: Cost of energy efficiency and load flexibility.

Table ES-1. End uses, technologies, and program types that can support load flexibility

Category | Technology examples | Program types | Application |

HVAC | Smart thermostats, advanced HVAC controls | Smart thermostat rebates, direct load control, time-of-use rates | Residential, commercial |

Water heating | Connected/smart water heaters, load-shifting controls | Direct load control, dynamic pricing, bring your own device (BYOD), smart water heater incentives | Residential, commercial |

Batteries | Distributed battery storage, commercial-scale storage | Installation incentives, virtual power plant (VPP) and battery aggregation programs | Residential, commercial |

Electric vehicles | Grid-interactive charging (smart charging, V2G/V2B, networked charging stations, etc.) | Off-peak charging incentives, managed charging, and smart charging equipment incentives that support grid-responsive EV charging. | Residential, commercial |

Large commercial and industrial demand response | Building management systems, automated DR platforms, onsite renewable generation/storage | Pay-for-performance, interruptibility agreements, time-varying rates, technology incentives | Commercial, industrial |

Whole-building | Any behind-the-meter load | Voluntary behavioral demand response; customers encouraged to reduce load using whatever method they choose | Residential, commercial, industrial |

There are roles for legislators, utilities, regulators, and large load customers in enabling EE and load flexibility to deliver their full potential. Many of these recommendations are well-established actions that have become increasingly valuable, but we also present new approaches specifically designed to meet the current moment. A list of approaches organized by the actors most responsible for their implementation is provided in table ES-2.

Table ES-2. Summary of demand-side actions decision makers can take to address load growth

Decision maker | Recommended actions |

Legislators |

|

Utility regulators |

|

Utilities |

|

Large load customers |

|

Download the research report

| Suggested Citation |

Specian, Mike, and Alex Aquino. 2026. Faster and Cheaper: Demand-Side Solutions for Rapid Load Growth. Washington, DC: ACEEE. aceee.org/research-report/u2601. |