A federal tax credit that supports the construction of new homes with low energy costs is under threat in Congress. Three owners share how it helps them save money and have a comfortable home.

A key federal tax credit spurred nearly 350,000 new energy-efficient homes built across the United States last year. The incentive to builders reduces purchase and living costs for homebuyers. Yet the major tax and budget bill recently passed in the U.S. House of Representatives would eliminate the credit and disrupt the supply of these new homes.

ACEEE estimates that this New Energy Efficient Home (45L) credit is set to drive the construction of over three million qualifying homes certified as ENERGY STAR or Zero Energy Ready Homes. These homes cut homeowner energy bills by about $450 per year on average and reduce the growing strain on the electric grid.

Ending the tax credit would disrupt the construction and increase the price of new efficient homes, a costly mistake—one that the Senate can now avert.

Below, three households share how the current tax credit has helped them.

| “Our energy-efficient home is amazingly comfortable—more so than any other house we've lived in. The utility bills are super low and will remain so for the life of the structure. That's the great thing about building a good home envelope: it's with you for life. We're really impressed with how the home has performed as an all-electric house in a very cold area. The Zero Energy Ready Spec was great because it helped decrease the decision-making we had to do as owners. The tax credit for our builder, Hill Construction, was also a great incentive to help us make it worth their while to go above and beyond their normal practices to build this for us.” – Ben & Sarah, Wisconsin |  |

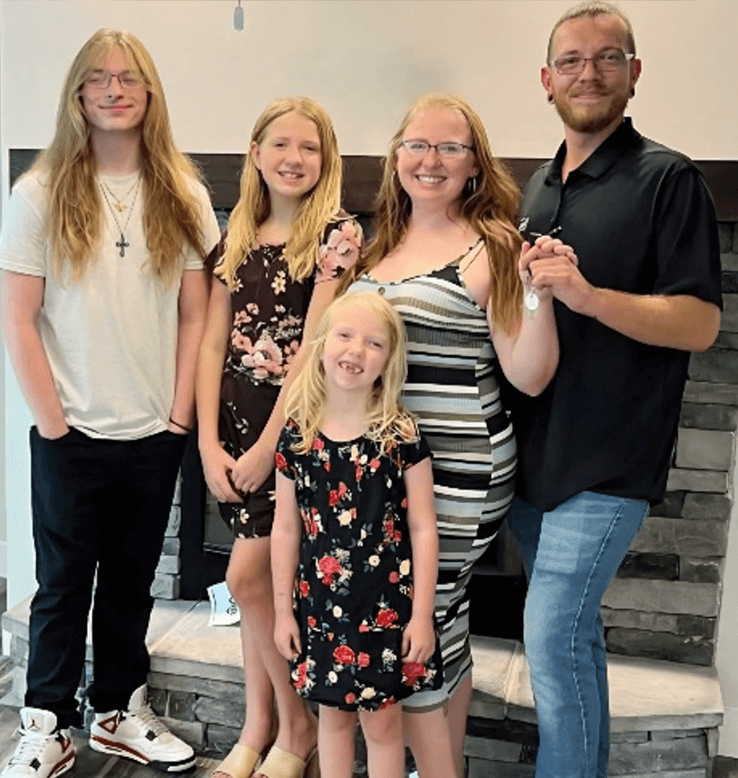

| “Since purchasing our DOE Zero Energy Ready manufactured home last year, it has become obvious that we made the best possible choice for our family. Having doubled our square footage, keeping our energy bill the same or lower is icing on the cake! Not only did it help keep our budget happy, but the smart thermostat and efficient HVAC system have provided a level of comfort that is priceless. We absolutely love the home and we look forward to many more years here to come.” – Justin, Tennessee |  |

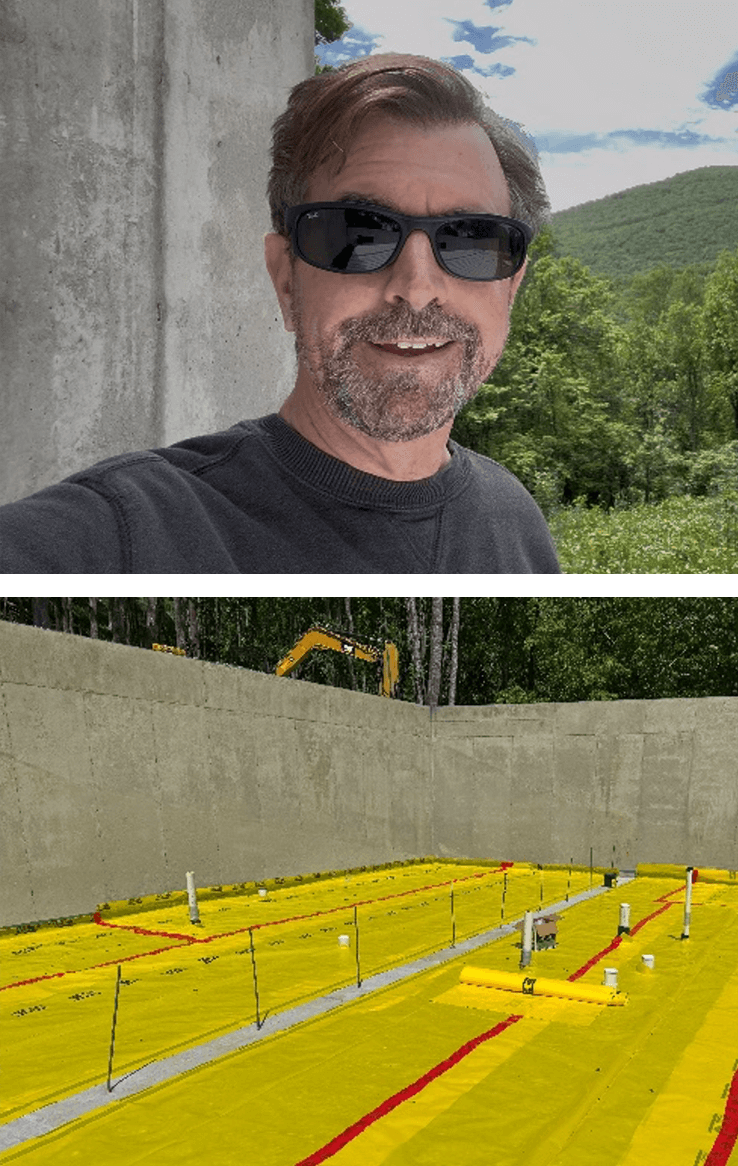

| “Using the federal tax credit, I am realizing my goal of designing and building my own super energy-efficient home. With my builder, Howard Building Science, we are building it to an efficiency standard that drastically reduces energy demand. The design includes a super-insulated, airtight building enclosure with high-performance windows, enabling superior comfort, indoor air quality, and durability while lowering maintenance costs. The airtight design also reduces noise and will help my home maintain comfort and survivability for several days without power when natural disasters knock out the grid. Because the utility bills will mean a lower total cost of ownership, it just makes financial sense.” – Mike, North Carolina |  |