In the US, electricity consumption has been essentially flat in recent years. Increased energy efficiency efforts have contributed to this lack of consumption growth, even as the US economy has grown. Looking forward, we believe that energy efficiency measures will likely drive consumption further down. However, there will be a variety of other trends affecting future electricity consumption and peak demand including:

- Accelerating use of distributed power generation on the customer side of the meter, such as photovoltaic (PV) systems, which decrease the power that must be supplied by the grid

- Growing use of electric vehicles (EVs)

- Possibly expanding use of electric heat pumps (HPs) to replace space and water heating equipment that burn fossil fuels

The pace of these different trends is hard to predict. As Niels Bohr has noted, “prediction is very difficult, especially about the future.” This said, it is useful to get a sense of how these trends might affect electricity consumption and peak demand in the future so that we can begin to plan ahead. Today, ACEEE released a paper that provides three scenarios on how these trends could affect one region in particular—New England. We chose New England because all of these trends are active in New England, based in part on regional efforts to address climate change.

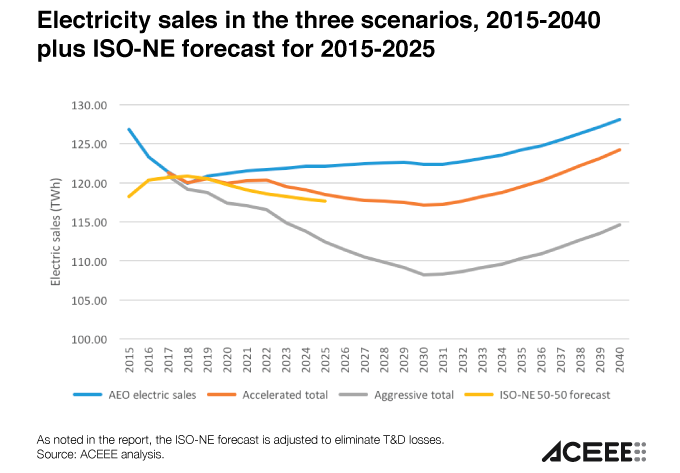

Our analysis includes a reference scenario as well as two alternative scenarios with progressively more aggressive assumptions about the use of energy efficiency, PV, EVs, and heat pumps. In the reference scenario (which comes from the Energy Information Administration’s Annual Energy Outlook), electricity sales decline until 2018 and then gradually rise. In our two alternative scenarios, sales decline more through about 2030 (due primarily to the greater energy efficiency included), but then increase over the 2030–2040 period as the electric vehicle and heat pump market shares increase significantly. Our three scenarios are presented in the figure below, which also shows the Independent System Operator—New England (ISO-NE) forecast that extends to 2025. The impacts of energy efficiency on sales are greater than the impacts of PV. Heat pumps and EVs both increase sales, with heat pumps having the larger effect relative to the reference case.

We also examined trends for summer and winter peak demand. In the reference case, both summer and winter peak demand modestly increase. ISO-NE also predicts gradually rising peak demand. In our more accelerated scenarios, summer peak demand declines and winter peak demand modestly grows. In our middle scenario, summer peak declines until about 2030 and then levels off before starting modest growth, reflecting the impact of EVs and heat pumps. (We assume that a significant share of heat pump growth occurs in homes lacking central air conditioning because adding air conditioning to a home can be a significant consumer motivator.) The increase in winter peak demand is driven by growth in EVs and heat pumps. In the most aggressive scenario, by 2040 summer peak demand is only a little higher than winter peak demand. And the trends are such that the winter peak could surpass the summer peak in the 2040s.

Of course, other scenarios are also possible, such as combining our more aggressive EV and heat pump scenarios with lower levels of efficiency and PV. Such scenarios would result in higher sales and higher summer peaks. The annual rate of efficiency savings shown in the accelerated and aggressive scenarios have been achieved in several of the New England states, although there is uncertainty about how many years these increased savings rates can be maintained. The levels of PV, EV, and heat pumps are more speculative and are subject to large uncertainty.

Both the ISO-NE forecast and our scenarios illustrate the importance of incorporating energy efficiency, as well as PV, into load forecasts. If energy efficiency and PV were not included, forecasts would be much higher, resulting in extra costs for ratepayers if the grid were designed to serve higher loads. Our scenarios also illustrate the importance of including EVs and heat pumps in long-term forecasts. While the impacts of these technologies are moderate over the next ten years (the period covered by the ISO-NE load forecast), for longer timeframes these technologies could become increasingly important.

At this point, it is probably premature for resource planning to put too much weight on these long-term scenarios. However, these scenarios do point out two possibilities that resource planners should keep in mind. First, it is possible that kWh sales and summer peak demand will no longer grow. Existing power plants will retire and may need to be replaced, and the grid will also need investment to replace aging equipment and address growth in some fast-growing regions, but significant growth in sales and resource needs above present levels are unlikely over the next 25 years. Second, over the longer term (post 2040), electricity sales could grow beyond current levels if EVs and heat pumps take off, and it is possible that the New England region will become winter peaking during this period.

We are entering a dynamic period with substantial uncertainty for long-term electricity sales and peaks. Trends in energy efficiency, PV, EV, and heat pump impacts need to be carefully observed and analyzed over the next few years. Resource planners should be sure to incorporate these emerging trends into their long-term forecasting and planning, giving them greater clarity and clearer direction. This observation and analysis may also keep energy consumption, energy costs, and energy sector emissions down while continuing to provide the electricity needed to grow the New England economy.