A federal tax credit is helping homeowners across the country make energy-saving improvements, but Congress is considering axing it. Five individuals who have recently used the credit share how it helped them reduce their energy costs.

A federal tax credit now under threat in Congress has helped millions of American homeowners make home energy efficiency improvements. The Energy Efficient Home Improvement (25C) credit, initially enacted in 2005 with strong bipartisan support and updated several times since, helps families across the country lower their utility bills, live more comfortably, and reduce strain on the electric grid.

Maintaining the tax credit is vital. ACEEE has found that it helps families save an average of $130 a year and could cut peak electric demand by 3,400 megawatts by 2032. However, the incentive could be weakened or eliminated as Congress considers eliminating a range of energy tax credits. Below, five individuals share how the current tax credit has helped them.

| “After getting a free energy audit from TVA and EPB EnergyRight that educated me on the most valuable energy upgrades to do in my home, I used their home energy rebates and the federal tax credit to help pay for attic insulation and air and duct sealing in my home. In January, I replaced a dual fuel heat pump and plan to claim a tax credit for that upgrade next year. These improvements are improving the comfort of my home, and I’ve already saved over $300 on my electric bills compared to the first 4 months of last year.” – Carrie, Tennessee |  |

| “With help from the IRA tax credits, my husband and I were able to make important upgrades to our 1940s-era home. So far, we've added insulation to our basement walls and rim joists as well as our attic, and replaced an aging gas water heater with a super-efficient heat pump water heater. The insulation has improved the comfort of our basement, and the water heater has enabled us to cut our gas bill with only a marginal increase in our electricity bill since the water heater is so efficient.” – Abby, Montana |  |

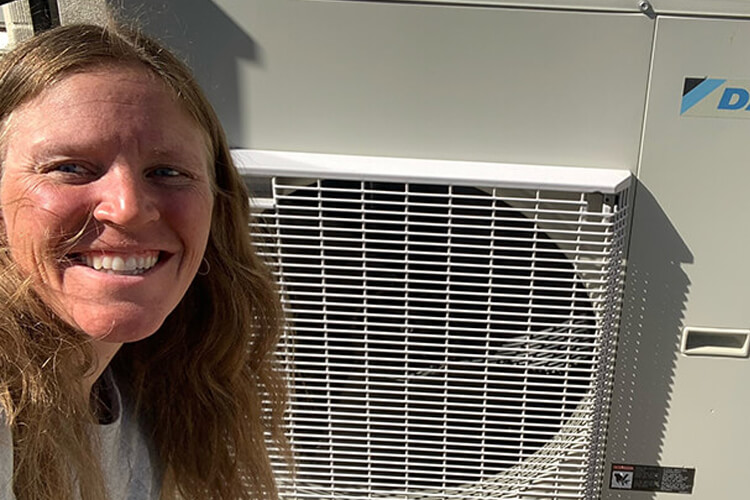

| “My HVAC heat pump is the best investment I have made in my home since purchasing it 2.5 years ago. It makes my home more comfortable in the summer and winter, and has resulted in lower utility bills in both seasons compared to my old forced air furnace and ducted AC. The tax credit made my investment financially feasible as it was able to reduce the cost of the installation when my project was not eligible for my local utility incentive program. As a result of the credit, I could make my project pencil, and it has made a difference in the comfort and operational cost of my home.” – Meghan, Utah |  |

| “We had no idea how energy efficient our home was when we bought it. The tax credit combined with a rebate from our local utility helped us get a comprehensive energy audit done for free to help identify ways to help make our home more efficient. After reviewing the results, we decided to get some insulation and air sealing done. We are now not only saving money on our energy bills, but our home is much more comfortable than it was before. The tax credit helped us make this project possible and was instrumental in ensuring that the project we did was affordable.” – Ben, Colorado |  |

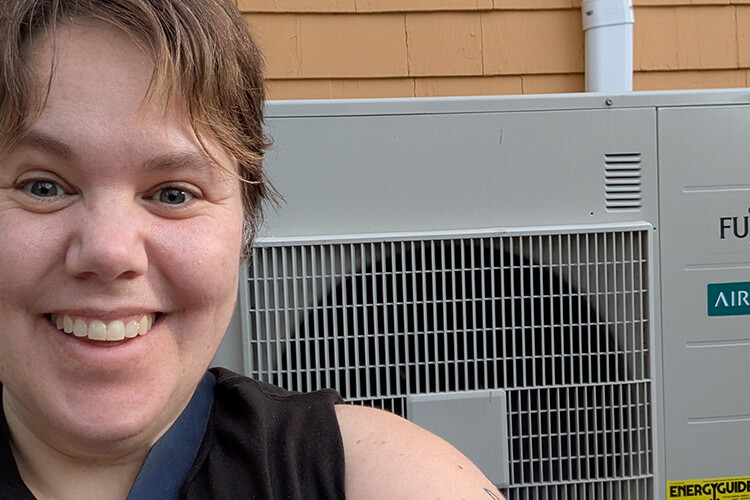

| “I was able to update my very old steam heating system with heat pumps. We are much more comfortable year-round and have added value to our house with a modern system. We are a family who lives mostly paycheck to paycheck and would not have been able to afford this home upgrade without the federal tax credits and state energy efficiency rebates.” – Emily, Massachusetts |  |

This Article Was About

Homes and Multifamily Buildings

Tax Policy

Federal Funding