Electric trucks—which are essential to reducing carbon emissions—have come a long way in many segments of the market, even in just the last 18 months. New models are entering the market, and policy efforts to grow vehicle sales and expand charging infrastructure are expanding rapidly, according to an updated ACEEE analysis published today.

Trucks, ranging from heavy-duty pickup trucks to 18-wheelers, account for 22% of vehicle CO2 emissions. They also emit substantial amounts of other pollutants, contributing to climate change and health problems. Electric trucks can dramatically reduce these emissions. Our update to an early 2020 report, Electrifying Trucks: From Delivery Vans to Buses to 18-Wheelers, shows rapid progress in product offerings, supporting infrastructure, and policy development. The report surveys the state of the electric truck market and related policies, summarizing and synthesizing a wealth of information in one resource.

Vehicles

Many new vehicle models have been introduced to the market in the past 18 months. For example, Amazon is now testing electric delivery vans on the road as part of a commitment to purchase 100,000 of the vans. Likewise, UPS will be purchasing electric delivery vans from Arrival, and Ford and GM have announced similar products. There has also been substantial progress on heavy-duty pickup trucks, with products announced from five manufacturers; deliveries of some are scheduled to begin later this year.

At the other end of the size spectrum, six manufacturers are now working with customers to road-test tractor-trailers that can go at least 150 miles before needing recharge, including one with a 500-mile range. Many of these trucks will be in limited production later this year. It appears that the Volvo VNR may be the first to market. For the most part, because of their range, these vehicles will initially target regional-haul routes.

Rivian electric delivery van for Amazon (left), Volvo VNR 18-wheeler (right). Sources: Amazon and Volvo.

Electrification of transit and school buses is also progressing. For example, a new Maryland law requires the Baltimore-area transit agency to only purchase zero-emissions buses starting in 2023. Four manufacturers are now selling electric school buses, including all three major suppliers to the North American market. Three manufacturers are even selling electric garbage trucks in the United States. Because these trucks make frequent stops, travel short distances, and are typically very noisy in their diesel versions, they are an ideal early application for electric vehicles.

Supporting Infrastructure

The Biden administration is proposing major federal investments in charging infrastructure, and many states and utilities are expanding and accelerating their own efforts. Southern California Edison, for example, is helping customers assess charging needs and offering incentives for chargers and associated electrical upgrades. Leading utilities are also starting to integrate future charging needs into their grid planning, although most have not yet begun to do so. Advance planning is crucial because electric power needs can be substantial. An individual 18-wheeler may need 1.6 MW of power to charge (equivalent to the power needed by 160 typical homes), electric delivery-vehicle fleets may need on the order of 4 MW, and one large bus fleet is now using 13 MW of power.

Policy

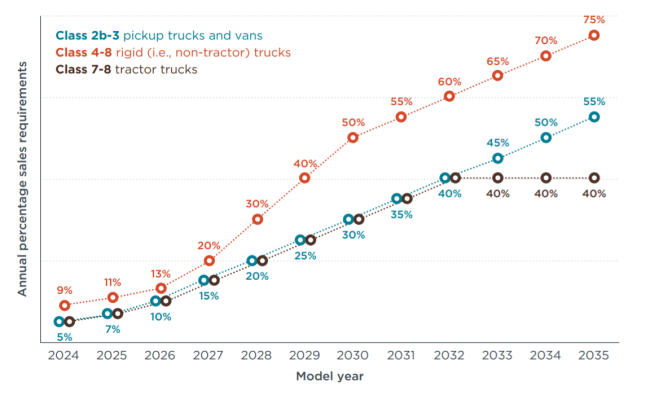

There have also been substantial policy developments in the past 18 months. California has adopted a standard requiring a growing percentage of trucks to be zero emission (generally meaning battery electric or fuel cell), as shown in the figure below.

California zero-emissions sales percentage schedule by vehicle group and model year. Source: ICCT.

A group of 15 states, many in the Northeast, plus the District of Columbia, have signed an agreement to consider similar heavy-duty targets based on the California program. Likewise, three Northeast states plus DC have signed an agreement to establish a cap-and-trade program for transportation emissions, with eight additional states pledging to coordinate their programs with these states. Money collected from auctioning emissions allowances will be dedicated to reducing transportation emissions, including some investments in electric trucks and infrastructure. At the federal level, expanded tax credits for electric trucks and infrastructure are being developed. For example, the Senate Finance Committee has reported out legislation to provide a 30% tax credit for electric truck purchases.

Next Steps

Our new report concludes that for electric trucks to thrive, federal and state governments, policy makers, utilities, truck manufacturers, and truck buyers/users must take a variety of steps, particularly to reduce purchase costs and expand charging infrastructure. Each of these stakeholders has an important role in this process of getting to zero-emission trucks.