Washington, DC—The Biden administration could save many low- and moderate-income households thousands of dollars—and cut greenhouse gas emissions—by updating energy efficiency requirements for new federally supported homes, according to a study today by the American Council for an Energy-Efficient Economy (ACEEE).

Congress directed federal agencies to periodically update efficiency criteria for new homes purchased with the support of federally backed mortgages and federal housing programs. But the regulators have not updated the criteria for most of the homes since 2015. The Department of Housing and Urban Development (HUD) pledged in July 2021 to take a key step toward updating the standards by the end of that year, but it has not yet done so.

The ACEEE study finds that updating the standards could save the average household in a federally supported single-family home nearly $2,800 in reduced energy bills, net of costs. And they could yield more than $5,700 in total net savings per household when including other benefits of improved homes, such as better health outcomes. The calculations were based over 30 years.

“Right now, taxpayer dollars are helping people get homes that just aren’t built to modern standards, and it leaves residents—often low- and moderate-income families—paying needlessly high energy bills,” said Steven Nadel, ACEEE executive director. “The good news is that Congress actually figured out years ago that there need to be some minimum efficiency standards for these homes. But it’s up to the Biden administration to get the update done.”

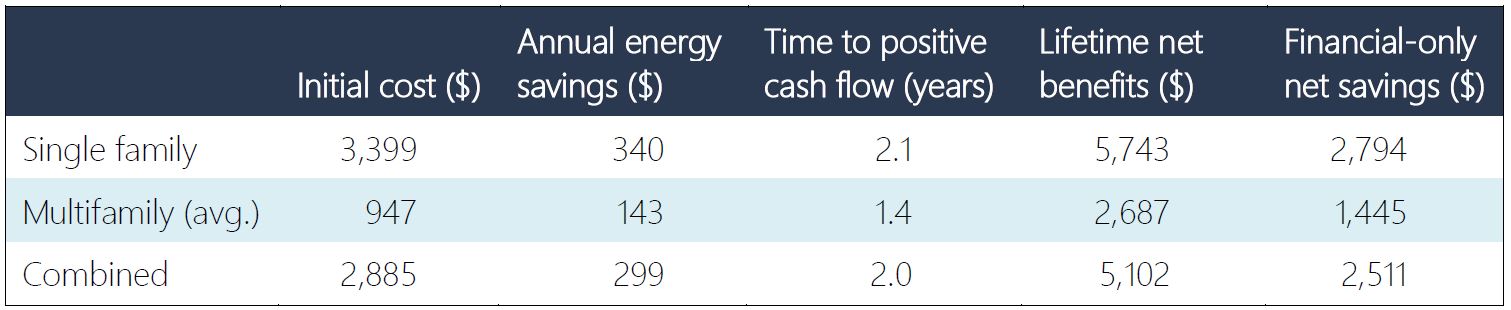

The study finds updated efficiency criteria would save households more in energy costs than they would increase mortgage payments, and could result in the following economic impacts for households in new federally supported homes:

The initial cost is the added cost of efficiency measures in a new home. Owners of single-family homes would recoup the added down payment (10% of the initial cost) after about two years (time to positive cash flow); paybacks would be even faster for the average apartment. Nonenergy benefits (including health benefits) are assumed to be equal to 50% of the energy bill savings and are included in the lifetime net benefits but not in the financial-only savings; both are discounted net present value.

In addition to the household savings, the study finds that updated efficiency requirements for federally supported homes could:

- Avoid 275 million tons of carbon dioxide emissions (cumulatively), equivalent to the emissions from 59 million cars and light trucks for a year

- Create 838,000 jobs (net added job-years)

- Generate $27 billion in total net savings (present value)

These nationwide numbers include the impacts of Fannie Mae and Freddie Mac—federally chartered companies regulated by the Federal Housing Finance Agency—adopting similar criteria for new homes with loans they finance.

Congress authorized the efficiency requirements—in bipartisan legislation passed in 1992 and revised in 2007—to ensure that federally supported homes do not burden residents with high energy costs. Updating the standards would ensure that the new homes have more insulation, are less drafty, have better lighting, and potentially have far-more-efficient water heaters or use heat pumps.

The law requires HUD and the Department of Agriculture (USDA) to update their criteria to match updated model building energy codes upon a determination that doing so would not negatively affect the availability or affordability of covered housing. Currently, HUD and USDA will need to issue a draft determination, solicit comment, and then issue a final determination; they haven’t yet issued the draft.

The single-family homes at issue in the law include new homes with loan guarantees or insured loans through Federal Housing Administration (FHA) and USDA mortgages, and to a lesser extent through HUD grant programs. A separate law requires Department of Veterans Affairs loan criteria based on the HUD-USDA provision. Such homes make up about 19% of all new single-family homes, ACEEE found.

The law also applies efficiency criteria to homes in multifamily buildings, including those with FHA mortgages and to new and rehabilitated units with support from HUD programs such as HOME Investment Partnerships grants for affordable housing, Rental Assistance Demonstration funding that is used to convert public housing to privately owned affordable rental properties, and public housing. Combined, the new homes in these categories represent about 13% of all new units in multifamily buildings in recent years.