To maintain global leadership in chemicals manufacturing, the United States needs a comprehensive strategy for reducing the sector’s carbon emissions.

The U.S. is the world’s second largest chemical producer, but our leadership is at risk. As international policies such as the European Union’s Carbon Border Adjustment Mechanism and a pending global plastics treaty shift markets toward less emissions-intensive products, the country with the cleanest chemical sector could become the future market leader. To be ready to meet these new competitive requirements, the U.S. needs to invest now in cleaning up chemical production.

A new ACEEE white paper evaluates whether current U.S. initiatives are sufficient to decarbonize the chemicals sector. We identified over 50 programs across 9 different federal agencies that reduce carbon emissions within the chemicals industry. Our conclusion? These programs are too small or fragmented to move the market. The United States does not yet have a national strategy with the scope and resources to pull the sector into a clean manufacturing future—a future where:

- carbon emissions from fuels and feedstocks are reduced to zero

- fossil fuel feedstocks are replaced at scale with recycled or biogenic carbon sources (so-called “defossilization” of chemical feedstocks)

- plastic waste no longer accumulates in landfills and the environment

- fence-line communities are not subject to the environmental injustices of toxic emissions from chemical facilities

Only the federal government is positioned to combine the need for sustainable alternatives with a loud enough market signal to shift the actions and investment decisions of chemical producers throughout the value chain. Without a comprehensive national plan to clean up the chemicals sector and additional decarbonization investments by Congress, the U.S. risks expanding the footprint of toxic and carbon-intensive petrochemical production to support growing supply chains, such as batteries, electric vehicles, semiconductors, and refrigerants.

Achieving net-zero emissions requires targeting both the material components and the manufacturing of chemicals

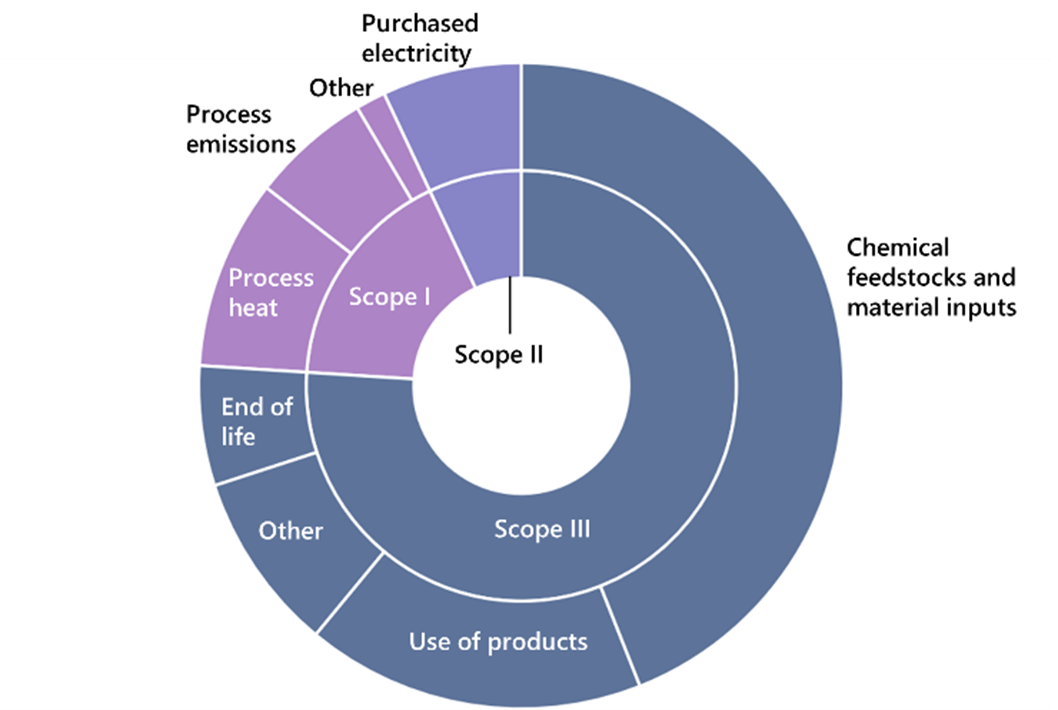

Chemicals are one of the top three industrial sources of U.S. carbon emissions. Chemicals production relies on carbon molecules for both feedstocks—the raw materials for chemicals—and fuel. In the U.S., the predominant feedstock is natural gas. Almost two-thirds of the carbon emissions from the sector are embedded in the final products themselves (Figure 1). The remaining emissions are from the energy consumed by facilities, process heating, and chemical reactions during the manufacturing process. If emissions reduction programs only target production-related emissions, we won’t even be halfway to a solution.

Our new white paper assesses whether federal programs support three essential activities: defossilizing feedstocks, decarbonizing manufacturing process emissions, and managing end of life and chemical demand. Each of these stages requires attention. Most federal programs address one of the first two stages: feedstock defossilization or manufacturing process decarbonization. Most feedstock-focused programs, however, are targeted at the research and development phases. Very few programs address products’ end of life or try to shift demand away from carbon-intensive and toxic chemical products.

Figure 1. Chemical value chain emissions broken down across scope 1 (18%), scope 2 (7%), and scope 3 (76%) sources. Data sources: CDP 2022; McGhee and Olano 2023

More federal support is needed to make less-toxic and lower-carbon chemicals cost-competitive

Almost half of the chemicals produced in the United States are bulk petrochemicals that are later used as ingredients in tens of thousands of specialty chemicals. Just seven chemicals dominate the market: benzene, toluene, xylene, ethylene, propylene, butadiene, and methanol. Focusing on the carbon intensity of these bulk petrochemicals can reduce emissions across the entire chemicals sector, but government action is critical.

Today, the lowest-cost chemistry dominates the bulk petrochemicals market regardless of how carbon- and pollution-intensive its production is, so finding sufficient return on investment for decarbonization technologies is challenging for companies. The immense capital investments in production infrastructure that petrochemical facilities require (often greater than $1 billion per site) also make it difficult for new market entrants to compete and deter established producers from changing their production methods.

We need two major changes: greater federal support—potentially in the form of production credits or similar programs tied to the carbon intensity of bulk chemical production—as well as a ready market for new, more sustainably produced products, similar to the growing demand for sustainable aviation fuel.

Clear market demand for clean chemical products is necessary to drive initial investments by producers

Because bulk chemical components are a relatively small portion of the products sold to end-users, higher-value products can absorb the cost of ambitious early decarbonization investments by chemical manufacturers with minimal impact on the price that consumers pay for the goods—but only if markets demand and are aware of the more sustainable products.

We can’t build market demand for clean products until we know which are clean and which are not. As a first step, the federal government can build comprehensive tracking and labeling programs to identify toxic releases and carbon hotspots buried deep within product supply chains, such as by expanding efforts like the EPA’s EcoLabels program. This would potentially reduce demand for cheaper but more toxic and carbon-intensive products and reward companies that invest now in sustainably produced alternatives rather than wait for U.S. standards to catch up to more forward-looking international markets.

Congress can also support a market for decarbonized and defossilized chemicals by requiring federal agencies, like the Department of Defense or the General Services Administration, to expand public procurement programs to include safer and lower-embodied-carbon alternatives to today’s chemical products. The Department of Energy (DOE) technology commercialization programs could also invest in scaling up less toxic chemical products (e.g., alternatives to fluorinated plastics) to minimize negative health impacts while ensuring that essential goods are still available to the market.

Investments today will set up this century’s industrial leaders

Over the last several years, the United States has invested in critical industries to support U.S. economic competitiveness—like the CHIPS and Science Act of 2022’s build-out of the domestic semiconductor industry. For those in Congress, there is an opportunity to find consensus again around the creation of a safer, decarbonized, and defossilized chemical industry. The long time horizon for project development and plant construction means that the leaders of a global net-zero chemical sector in 2050 could come from investments made this decade.