With more than a million new EVs hitting U.S. roads each year, the grid can be optimized to accommodate EV charging needs while lowering rates for electric utility customers.

Electricity sales are increasing in many regions of the country, driven in part by growing power consumption from industry and data centers and, in some regions, by the energy needed for electric vehicle (EV) charging. While concerns are sometimes raised that EV charging will raise electric rates, three recent studies find that the load growth caused by EV charging can actually reduce electricity prices because EV charging can spread fixed electricity system costs over a larger volume of sales, modestly reducing per kilowatt-hour (kWh) rates. Each utility service area is unique, so utilities and state regulators should conduct their own assessments to see whether these trends apply to them.

New York State study

In April 2023, Synapse Energy Economics published a study on the investment and rate impacts of expanding truck electrification in the two largest utility service territories in New York State (Con Edison, serving the New York City area, and the portion of National Grid’s service area in Western New York). The study considered the costs of distribution upgrades and “make ready” programs that assist vehicle fleet owners with the costs of electric service upgrades so they can install and operate chargers for medium-duty vehicles (e.g., delivery vans and trucks) or heavy-duty vehicles (e.g., buses and tractor-trailers).

Synapse found that these investments would have a neutral-to-beneficial impact on electricity rates in both utility service areas for 2023–2045. With unmanaged charging that does not encourage customers to charge their EVs during off-peak hours and a 3 percent real discount rate (discounting is an economic calculation to account for the fact that a dollar saved today is worth more to consumers than a dollar saved tomorrow), the net revenues in Con Edison’s service territory would increase by $820 million, more than offsetting utility costs to accommodate EV charging and enabling modest rate reductions (fractions of a cent per kWh for all ratepayers). In National Grid’s territory, Synapse found that unmanaged charging generates a net revenue increase of $320,000 during the same period, enabling small rate reductions. Under a managed charging scenario that shifts charging to off-peak periods and thereby decreases each vehicle’s peak load by 20 percent, the cumulative net revenues are positive but lower due to rate discounts provided to customers who enroll in managed charging.

Synapse concludes that “these positive net revenue results imply that socializing the costs of make-ready and distribution system upgrades necessary to meet New York State’s MHDV electrification targets are unlikely to cause ratepayer bills to increase in either of the utility service areas studied, due to being offset by the revenues contributed by MHDVs over the same period.”

Berkeley Lab study

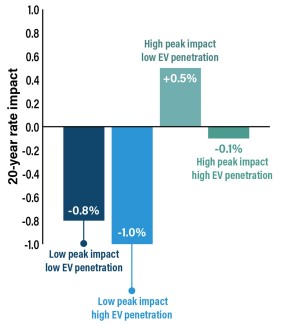

In February 2023, Lawrence Berkeley National Laboratory published a U.S. Department of Energy-funded study titled “Quantifying the Financial Impacts of Electric Vehicles on Utility Ratepayers and Shareholders.” This national study looked at low and high EV penetration and also low and high peak impacts per vehicle (in which low peak impacts include managed charging). Depending on the scenario, over 20 years, electric rates for all customers ranged from a 0.5% increase to a 1% decrease, as shown in the figure below.

The study also looked at rate impacts by year, finding some rate increases in early years (due to front-loading of costs and limited new revenues), but rate decreases in later years as revenues increase.

California data

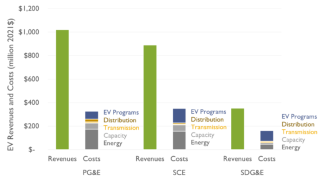

In December 2022, Synapse looked at costs and revenues associated with EVs from 2012 to 2021 in the service areas of California’s three largest utilities—Pacific Gas & Electric, Southern California Edison, and San Diego Gas & Electric. The study found that over this period, EV drivers in these service territories “contributed approximately $1.7 billion more in revenue than the associated cost, driving down rates for all customers.” This is because only 8–17% of charging (varying by utility) occurs during peak hours. Results by utility are illustrated in the figure below.

Implications and next steps

Every utility territory is different, but with three studies reaching similar conclusions, on top of some earlier studies examining similar issues (e.g., in Minnesota and Illinois), expanding EV charging could lower costs for most utility customers. Other utilities and states should conduct their own analyses to see whether these trends apply to them. Concerns about rate impacts on non-EV customers are mostly unsupported. Utility programs encouraging the use of EVs should be expanded as a strategy to reduce vehicle emissions, better use utility assets (since much charging occurs at night), and modestly reduce electric rates for all customers.